Nigeria’s expansion rate arrived at a 20 percent mark in August 2022, mirroring the increasing cost for many everyday items emergency confronting Nigerian families and firms.

It was the greatest expansion numbers since October 2005 with the expense food hitting 23.12 percent on a year-on-year premise, addressing a 2.82 percent increment from 20.30 percent in August 2021.

On a month-on-month premise, expansion rose to 20.52 percent in the long stretch of August, from 19.64 percent in July, as per the most recent Ware Value Record report distributed by the Public Department of Measurements on Thursday.

The CPI estimates the typical month to month change in the costs of labor and products in a country.

As per the NBS, the expansion rate was 3.52 percent focuses higher contrasted with the rate kept in August 2021, which was 17.01 percent.

This intends that in August 2022, the general cost level was 3.52 percent higher comparative with August 2021.

The rate change in the normal CPI for the year time frame finishing August 2022 over the normal of the CPI for the past year time frame was 17.07 percent, showing a 0.47 percent increment contrasted with 16.60 percent kept in August 2021.

As per the measurements body, the Increments were kept in all arrangements of individual utilization by reason divisions that yielded the title record.

Increasing expense

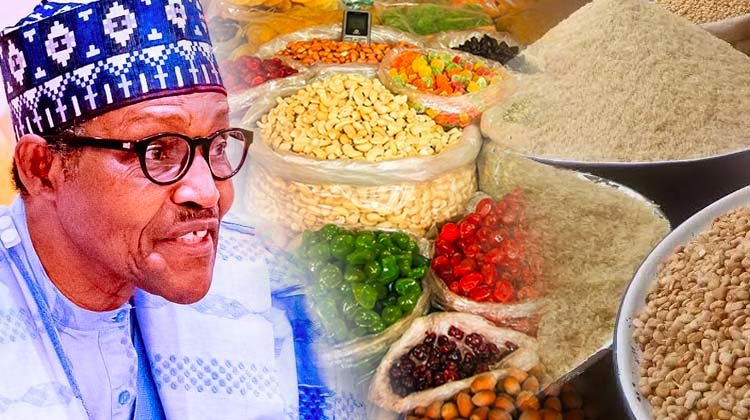

A further breakdown of the CPI report showed that metropolitan expansion remained at 20.95 percent, while country expansion was 20.12 percent. Food expansion, then again, likewise rose to 23.12 percent.

The report likewise said the food expansion rate in August 2022 was 2.82 percent higher contrasted with the rate kept in August 2021 (20.30 percent).

This ascent in the food expansion was brought about by expansions in costs of bread and cereals, food items, potatoes, sweet potato and other tuber, fish, meat, oil and fat.

In August 2022, all things expansion rate on a year-on-year premise was most elevated in Ebonyi (25.33 percent), Streams (23.70 percent), Bayelsa (23.01 percent), while Jigawa (17.30 percent), Borno (17.56 percent) and Zamfara (18.04 percent) kept the slowest ascent in title year-on-year expansion.

On a month-on-month premise, be that as it may, August 2022 kept the most elevated expansions in Anambra (2.78 ), Ondo (2.53 percent), Nasarawa (2.40 percent), while Yobe (0.68 percent), Borno (0.84 percent) and Zamfara (0.98 percent) recorded the slowest ascent on month-on-month expansion.

The increment to 20.52, which further deteriorates the 17-year high arrived at in July when expansion hit 19.64 percent in July, likewise suggests a worsening of the typical cost for many everyday items emergency that has seen the cost of items and administrations soar in the beyond couple of months.

Market analyst faults strategy

In making sense of the potential causes behind the proceeded with expansion in inflationary strain, specialists have refered to variables, for example, disturbance in the stock of food items, expansion in import cost because of the steady cash devaluation and a general expansion in the expense of creation as the significant drivers.

Talking solely with The PUNCH, a financial expert, Teacher Akpan Ekpo, depicted the rising expansion true to form, taking into account Nigeria’s ongoing monetary real factors.

The scholar, who addresses at the College of Uyo, further expressed the extreme spending by the political class to subsidize their electioneering efforts had likewise added to filling the inflationary strain. This, he said, had prompted “an excessive amount of cash pursuing too couple of products.”

“I’m amazed it’s not higher,” Ekpo said.

“That is the issue, a lot spending by government officials. The National Bank of Nigeria is as yet giving the public authority cash since they don’t have the foggiest idea how to tell the public authority ‘no’. Thus, I don’t see the expansion rate descending this year.”

Inquired as to whether the choice by the Financial Arrangement Panel to increment base loaning rate had helped check the expansion in expansion, Ekpo said, “What MPC does is to expand the loan fee to abridge development and speculation, however it doesn’t work on the grounds that our economy isn’t the U.S economy. Their money, the dollar, is both a homegrown and a worldwide cash. It is convertible.

“In our own case, naira isn’t convertible. So the conversion scale hole, the hole between the authority rate and the underground market, is excessively wide. With the conversion standard system reinforced by government officials burning through cash, I don’t see it descending. The MPC might meet and expand the rate, it won’t transform anything. They’ve done it two times, yet, as they make it happen, expansion continues to speed up. Along these lines, they need to consider setting up venture approaches.”